Simple pension advice.

Whether old age, disability or death: show your customers quickly and understandably which insurances they need.

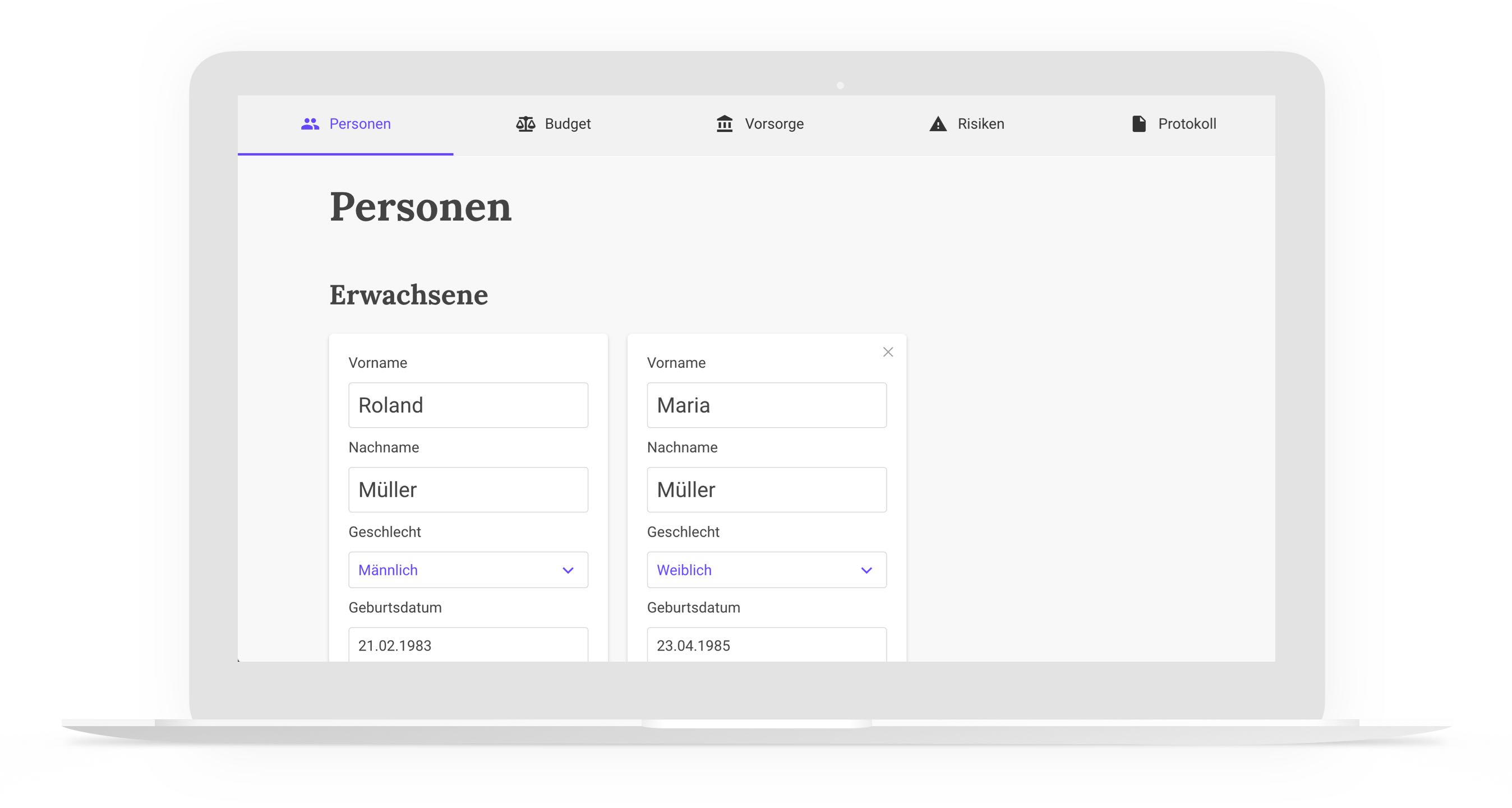

Step by step through the conversation.

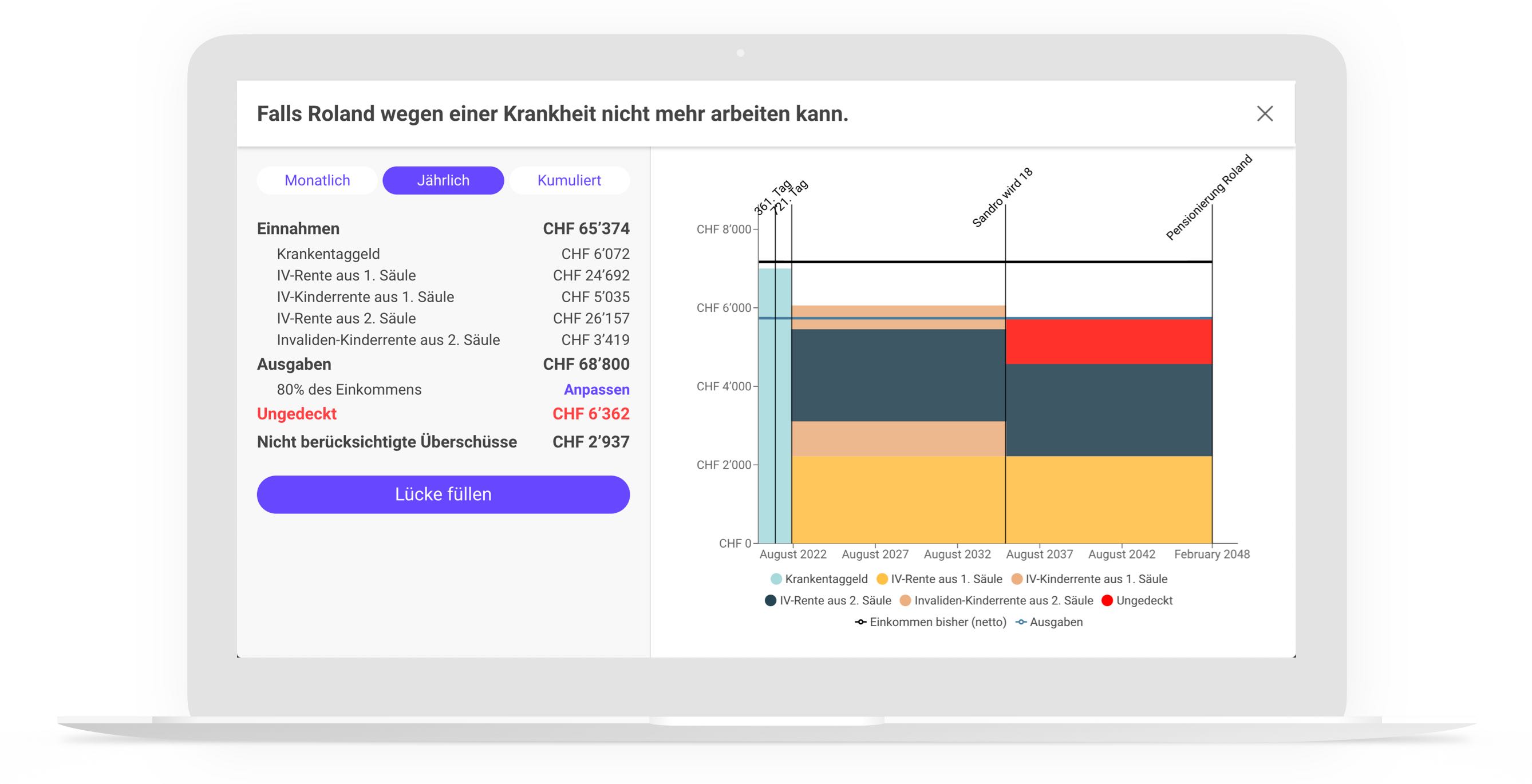

Create a personalized needs analysis for your clients in just a few minutes - directly during the consultation. The simple and easy-to-understand graphics show pension gaps in the areas of retirement, disability and death.

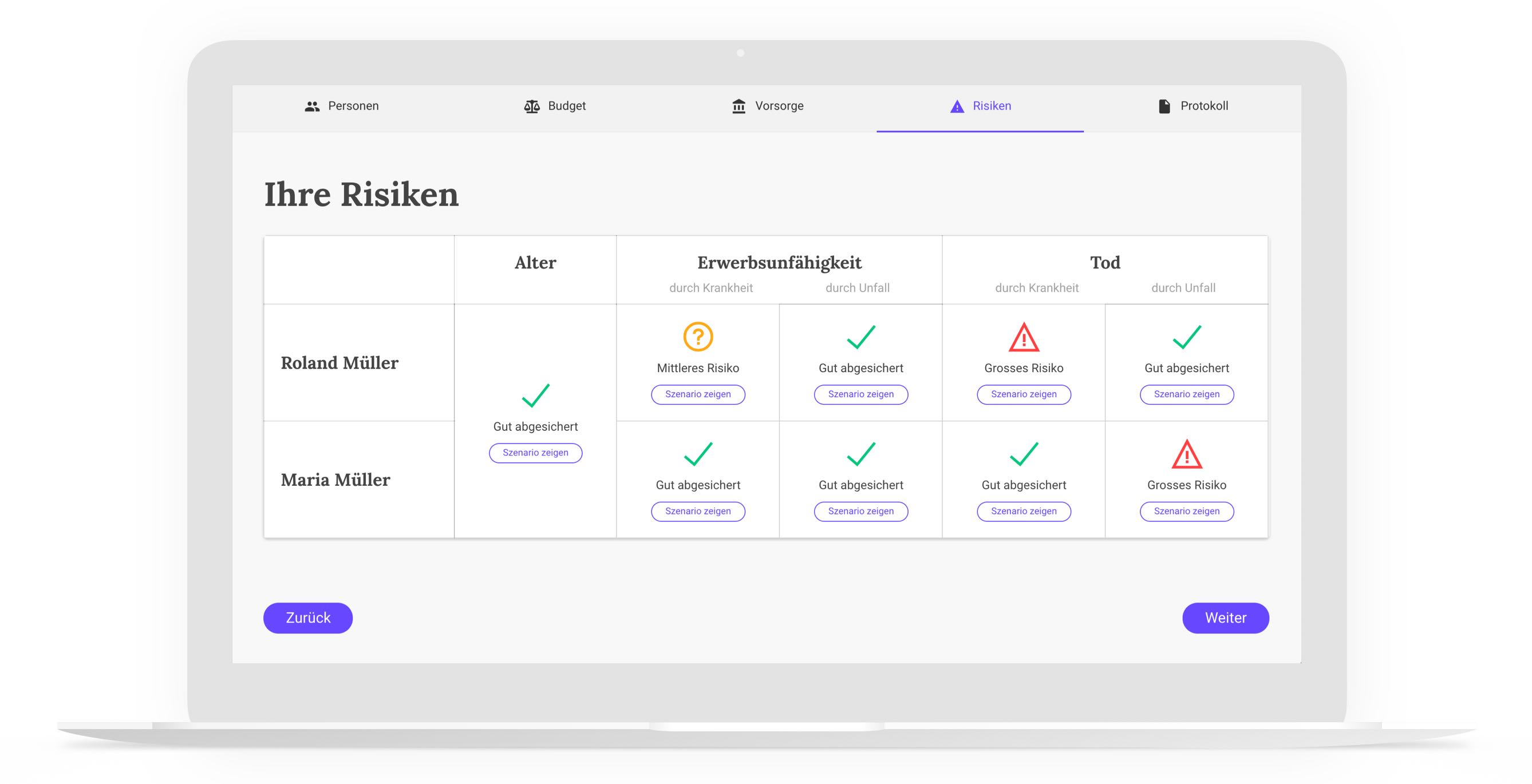

Clearly identify risks.

The life-phase pension analysis serves to protect customers and to ensure long-term customer loyalty. Vorsorge360 offers customers a decision-making aid and it is an advisory aid for you. For end customers, the subject of pension provision is finally becoming understandable and comprehensible.

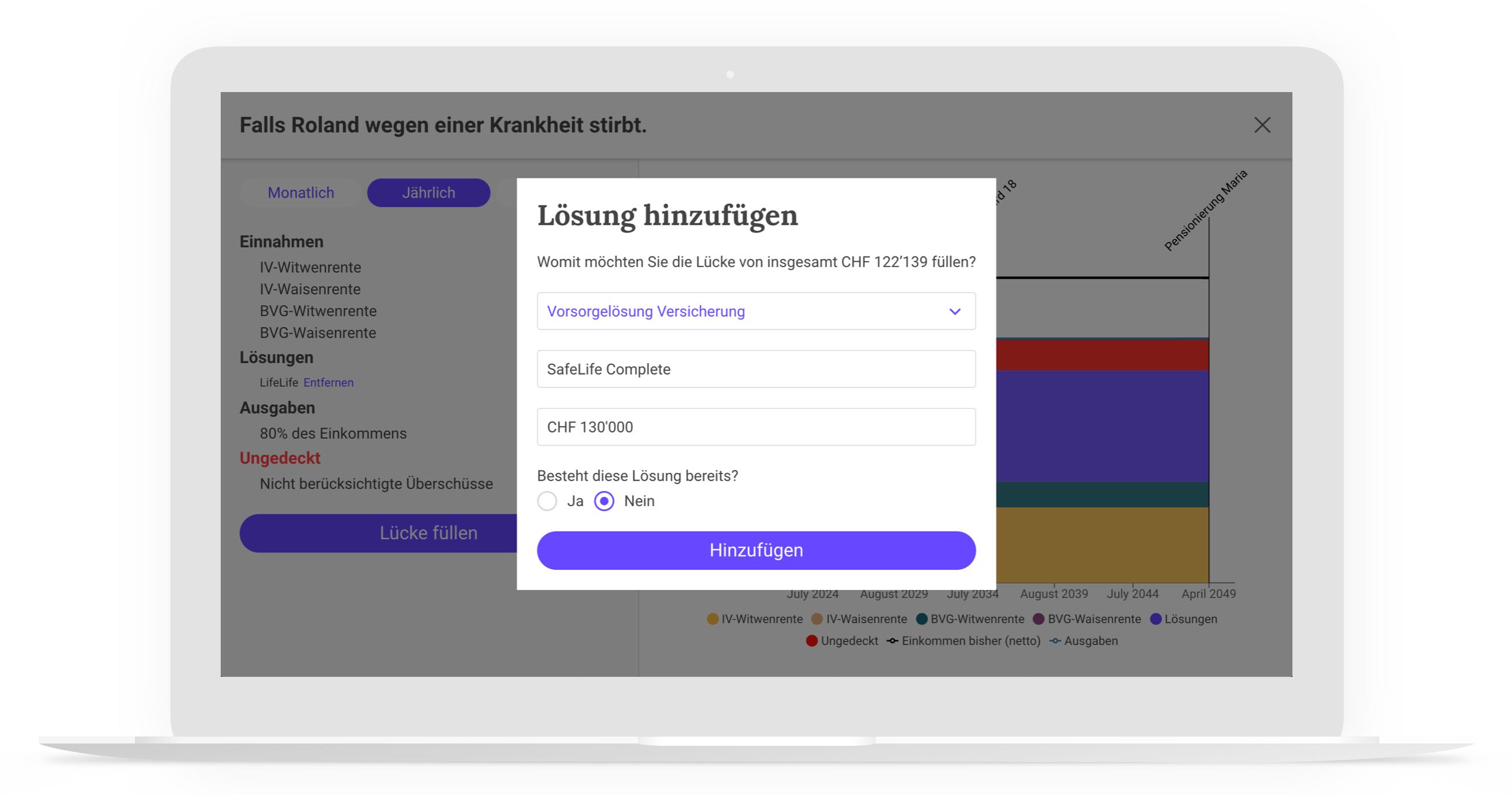

Enter solutions directly.

Use suitable product suggestions to show your customers possible solutions and thereby promote the sale of selected products.

Vorsorge360 supports you with these tasks:

With the understandable visualization of the pension situation of your customers. Possible gaps in coverage are determined within a few minutes and can be secured directly in the tool with pension solutions.

Clear presentation of the economic effects of incapacity to work due to illness or accident and in the event of the death of a partner, as well as showing the risk situation in old age.

The calculation of your customers' AHV and BVG benefits based on income and a stored wage development model, whose approximate values you can use directly for your calculations or overwrite.

Usage and maintenance

To ensure that Vorsorge360 is always up to date, you will receive regular updates (e.g. changes in the legal situation) as part of our maintenance promise. Vorsorge360 can be used with any operating system and therefore gives you maximum flexibility in terms of using our web app. Your maintenance package includes: updates when the legal situation changes, updates when errors are corrected, technical developments.

Consultants love Pension360.

Easy and fast budget calculation as well as flawless risk assessment due to accident and illness. A must for every financial advisor!

Petar Petrovcic, Pi Financial Planning Ltd.

Vorsorge360 is super easy to use and simple for any client to understand. A must for every pension consultation!

Roman Bütler, Optimatis

Vorsorge360.ch is easy to use and very helpful in pension consulting, you can present a simple and comprehensible solution to the customer. I can highly recommend Vorsorge360 to any advisor who wants to work more efficiently and easily.

Lucas Ibanez, Ibanez Consulting

7 days free trial.

And thereafter only CHF 799 per annual.